CLICK HERE FOR CIVIL PROCESS SERVICES AND FEES

These contact telephone numbers and links to other internet web pages give you information on certain public services provided by the DeKalb County Sheriff’s Office or other government, non-profit, or law enforcement agencies.

Alcohol Permits

DeKalb County Police Department 404-297-3934

Animal Services and Enforcement

Visit www.dekalbanimalservices.com or call 404-294-2996

Business Licenses

DeKalb County Government 404-371-2461

Domestic Violence

DeKalb Sheriff’s Office Domestic Violence Unit 404-298-8300

Evictions

DeKalb County Magistrate Court/Civil Division 404-371-2261

Jury Duty

Superior Court Clerk’s Office 404-371-2022

Police Precincts

DeKalb County Police Department

North-Central Precinct 770-724-7600

Tucker Precinct 678-937-5301

South Precinct 404-286-7900

East Precinct 770-482-0300

Pistol Permits

DeKalb County Probate Court 404-371-2601

Sex Offenders

DeKalb Sheriff’s Office Sex Offender Unit (SORT)

(404-298-8397 days; 404-298-8200 nights)

To access the national Sex Offender Registry to find registered sex offenders in your community, CLICK HERE

Victim Notification Service (VINE)

To be notified of the release of an inmate, CLICK HERE and register at the Victim Notification website.

Secondary Metal Recyclers Registration

Pursuant to O.C.G.A. § 10-1-360, secondary metals recyclers who purchase regulated metal property in any quantity must register with the appropriate sheriff’s office(s) beginning July 1, 2012.

Registration Process

Annually, the Office of Sheriff is required to register secondary metals recyclers doing business in the county, keep a record of each registration, and cause the registration information to be entered into a statewide data base searchable by all law enforcement agencies. THE REGISTRATION FORM, authorized by the Secretary of State, must be used for the registration process.

- The recycler must submit a completed form in person to the appropriate sheriff’s office(s).

- Obtain a copy of the driver’s license or other identification of the person submitting registration documents.

- If the recycler is a qualified alien or non-immigrant, SECURE AND VERIFIABLE DOCUMENTATION must be attached to the application. A list of verifiable documents is included with these instructions.

- Inform the recycler that pursuant to HB872, the statutes that pertain to secondary metals recyclers are: O.C.G.A. § 10-1-350 through O.C.G.A. § 10-3-363, O.C.G.A. § 40-3-36, and O.C.G.A. § 40-3-56. The recycler must be familiar with these statutes. The recycler can visit the Georgia Recyclers Association website to review a summary of relevant laws. This information is on the registration form.

- The sheriff’s office must complete page 3 of the registration form.

- Annually collect a non-refundable registration fee of $200, which must be remitted to the county governing authority. Registrations cannot be considered without full payment of $200.

NOTE: You must bring two separate checks, cashier’s checks, or money orders – each in the amount of $100. One payment should be made payable to the DeKalb County Sheriff’s Office and the other payment should be made payable to the Georgia Sheriff’s Association.

- Each registration is valid for a twelve month period beginning with the effective date of registration established by the sheriff’s office once all registration requirements are met.

- The record of each registration will be entered into an electronic data base accessible statewide.

How the Appropriate County of Registration is Determined

Business (Corporation or Partnership)

The recycler registering as a business must register with the sheriff in the county where the place of operation is maintained. If the recycler maintains a place of operation in more than one county, he/she must register the business in each county.

Individual (Sole Proprietor)

An individual must register in the county where he/she resides.

Non-resident of Georgia

A recycler who is not a resident of Georgia must register in the county where he/she primarily engages or intends to operate as a secondary metals recycler.

Raffle Licensing

In Georgia, county sheriffs are charged with enforcing the Georgia Raffle Law, which was enacted in 1995. Fund-raising lotteries or raffles are considered games of chance, and are therefore regulated by the state.

Only nonprofit tax-exempt entities, such as churches, schools and civic organizations, are allowed to perform a raffle. Eligible entities are nonprofit organizations qualified under §501c of the Internal Revenue Code, or bona fide nonprofit organizations approved by the sheriff. Georgia law §16-12-22.1 requires such organizations to obtain a license from the Sheriff’s Office of the county in which the nonprofit organization is located.

In addition, to obtain a raffle license, the organization:

- must have been in existence for a minimum of 24 months

- must pay an annual fee of $100 to the Sheriff’s Office

If the organization conducts no more than three raffles during a calendar year, the Sheriff’s Office can issue a special limited license and waive the fee.

The license will expire on December 31st in the year of issuance, so it must be renewed to conduct annual raffles. Renewal applications must be submitted prior to January 1st of each year. By April 15th of each year, the licensed organization must file with the Sheriff’s Office a professional accountant’s independently prepared report of receipts and disbursements from raffles conducted in the previous year.

For more detailed information about license requirements:

- Review the APPLICATION FOR RAFFLE LICENSE

- Review the CONSENT FORM

- Review the QUICK REFERENCE LIST

- Review the RAFFLE LICENSE INFORMATION

Operating a raffle without the license or failing to meet the requirements is a violation of Georgia Law and subject to prosecution.

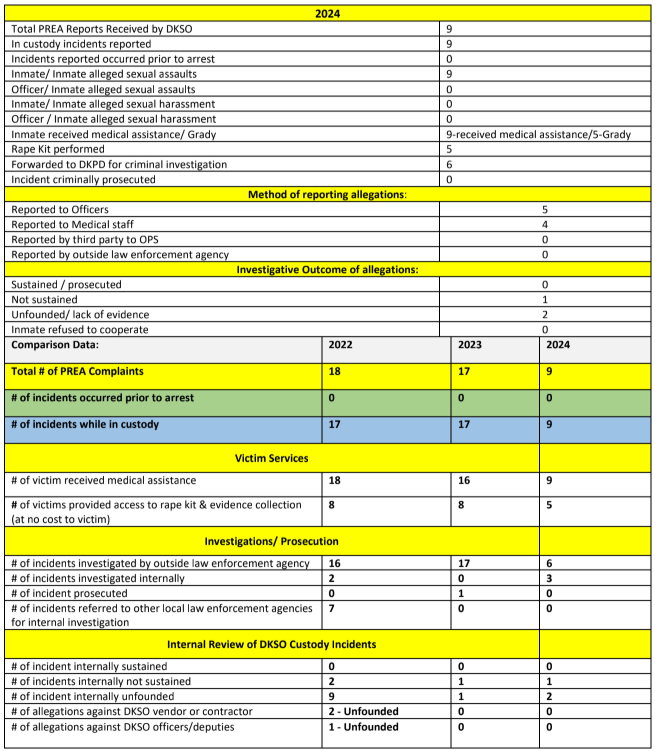

PRISON RAPE ELIMINATION ACT (PREA)

The DeKalb County Sheriff’s Office (DKSO) maintains a zero tolerance policy towards all forms of sexual abuse, sexual harassment, and sexual activity amongst approximately 1853 inmates housed daily at this facility. DKSO has implemented a PREA policy to further strengthen the agency’s efforts to prevent all forms of abuse and harassment, by implementing key provisions of the U.S. Department of Justice’s standards for the prevention, detection, and response to sexual abuse in confinement facilities, in accordance with the Prison Rape Elimination Act of 2003 (PREA). Policy requires an Annual PREA Report to provide public notification of statistical data related to the PREA outcries, investigation statistics, and documentation of the specific actions taken by our staff to assist inmates in our custody.

DKSO staff members are trained to respond to, investigate, and support the prosecution of sexual abuse according to our correctional procedures. Through continuous education of staff and inmates, DKSO has increased awareness of safe reporting and provided services to victims, thereby creating a culture that discourages sexual abuse. Through housing and classification assignments, DKSO identifies, separates, and monitors sexual predatory inmates and vulnerable inmates to reduce incidents of sexual abuse within our facility. In 2024, the Sheriff’s Office received fifteen (9) reports of alleged abuse. These outcries were processed per policy and procedures. All victims were offered and provided medical assistance. DKSO ensured direct contact with DeKalb County Police Department to assist each inmate in filing a formal criminal complaint. Inmates were transported to Grady Memorial Hospital for additional resources and care. Below is a general overview of the case activities and outcomes. Note: Inmate’s personal information is deleted due to confidentiality and protection of the parties involved.

DKSO policies stress the agency’s zero-tolerance policy and provides guidelines to address prohibited and/or illegal sexually abusive behavior which involves inmate perpetrators against staff victims, inmate perpetrators against inmate victims and staff perpetrators against inmate victims. Our officers, vendors, and volunteers are trained to detect incidents, perpetrators, and inmate victims of sexually abusive behavior and how to seek assistance. DKSO staff are educated on how to intervene properly and in a timely manner by documenting, reporting, and investigating all reported incidents. The training teaches our staff how to collect evidence to assist DeKalb Criminal Investigation Division (CID) in prosecuting perpetrators.

The protection and safety of our inmates is a top priority. The Sheriff’s Office recognizes that addressing inappropriate sexual behavior by inmates and/or staff furthers the objectives of PREA by increasing the overall security and safety of institutions. DKSO maintains a partnership with local law enforcement and victim services within DeKalb County to formally prosecute cases. All outcries of sexual assault generated a report of the case, even if the incident occurred prior to arrest, while in custody at the DeKalb County Jail.

The Office of Professional Standards works hand in hand with the agency’s PREA Coordinator, medical staff, Jail Commanders, inmates with community resources to monitor the outcries of abuse, ensures the staff properly responds and provides the inmates with the same resources that would be available to any DeKalb County citizen. The annual review of reported incidents provides specific comparison data to track issues or concerns while ensuring the officers follow specific policies and procedures.

Our Office of Professional Standards (OPS) performs reviews of all PREA case files to ensure that DKSO staff followed proper procedures.

REPORTING AN INCIDENT OR CLAIM

The DeKalb County Sheriff’s Office provides several options for third party reporting of incidents or

claims. To report an incident on behalf of an inmate or detainee, you can:

- Notify a DeKalb County Sheriff’s Office staff member,

- Call the DeKalb County Sheriff’s Office PREA Hotline at 404-298-8109,

- Contact the Office of Professional Standards:

- By phone at 404-298-8125,

- In person at 4415 Memorial Drive, Decatur, Georgia 30032

- By letter mailed to the above address

- Online using the COMMENT FORM

The Office of Professional Standards performs reviews of all PREA case files to ensure DKSO staff followed proper procedures. In 2024, DKSO continued to focus on creating multiple means of reporting abuse by allowing the inmate to report the incident to a confidential hotline or directly to our medical staff by submitting a medical grievance via the inmate kiosk located in each housing unit. These methods will allow the inmatesto report incidents without directly having to report to a sworn officer, and in a private manner, which may not be overheard by other inmates. The PREA showed four (4) of the nine (9) allegations were reported directly to DKSO staff and/or medical vendors verbally. Five (5) reports were made to officers. Inmates receive orientation about the facility procedures, rules, regulations, and

methods of reporting issues. The Sheriff’s Office has created a PREA presentation that will provide information to all inmates within the first 48 hours of arrest and prior to the classification of a housing unit. The orientation involves verbal communication with an officer who is specifically trained to handle any concerns presented by the inmate. The data showed that while confidential methods are provided, the inmates felt confident the officers would act accordingly if an allegation was reported.

The number of reported incidents involving inmates in custody showed a significant decrease between 2023 (17) and 2024 (9). A review of case investigative files has confirmed that staff members immediately notified supervisors, separated the inmates for safety, and attempted to preserve evidence. All inmates in custody were taken to our medical infirmary for evaluation and/or treatment. If applicable, these inmates were transported to Grady Memorial Hospital for additional treatment and a rape kit at no cost to the inmate. Grady Memorial Hospital employs certified forensic nursing staff to properly obtain evidence, provide assistance, and address the needs of the victims. DKSO is in contract with Grady Memorial Hospital to assist in the processing of the rape kits, address medical concerns, and provide additional resources for our inmates.

The DeKalb County Sheriff’s Office was awarded this $150,000 PREA grant in 2015 for a 2016-2018 two-year spend: DKSO Project SafeGuard: Establishing “Zero Tolerance” for Sexual Assault BJA-2015-4174 Respectfully submitted by the DeKalb County Sheriff’s Office (Georgia). The project included the development of PREA related policy and protocol review, provided education to staff and inmates, and established clear mandatory reporting procedures for inmates who make allegations. DKSO used project funds to contract with expert advisors that reviewed our new policy and classification procedures surrounding PREA to make suggestions for implementation of the new standards. The outside sources of evaluation were essential in providing an unbiased critique of our procedures. The BOJ allotted our

PREA staff the ability to attend a National Conference for training and networking opportunities, which permitted our agency to learn best practices from agencies throughout the United States. The grant project successfully completed all seven goals that were set for the project and completed the required federal documentation prior to the deadline. Our goals provided a clear path to ensuring DKSO utilize the allocated funds in ways that benefited our inmates, staff, and the community in which we serve.

The Sheriff’s Office appreciates the collaborative efforts from our community partners, fellow law enforcement agencies, and our contracted medical and mental health vendors. We work together to increase safety for the most vulnerable inmates in our facility while strengthening the foundation of safety for all inmates and staff members.